As Nigeria grapples with economic challenges, an increasing number of Nigerians are resorting to expensive emergency loans to meet essential expenses, raising concerns about a potential consumer debt crisis. The country’s economic difficulties, marked by high inflation and a controversial government austerity drive, have strained incomes, making payday loan providers more prevalent.

Individuals like Samuel, the owner of a small dry cleaning company in Lagos, described the situation as becoming “enslaved.” Samuel, who owed money to multiple fintechs at interest rates as high as 40 percent, highlighted the economic impact of President Bola Tinubu’s removal of fuel subsidies, tripling the cost of petrol since May and leaving many with no option but to borrow.

Recent economic indicators underscore the challenges faced by ordinary Nigerians, with food prices surging by 31.5 percent compared to the previous year. Bus fares in Nigerian cities have seen a staggering 117 percent year-on-year increase. The depreciation of the naira, coupled with an import-dependent economy, contributed to an overall rise in consumer prices by 27.3 percent in the year to October, reaching the country’s highest inflation level in two decades.

The World Bank reported that “entrenched inflation” has pushed an additional 4 million Nigerians into poverty this year. Government statistics indicated that 63 percent of the population, around 133 million people, were already considered “multidimensionally poor,” creating a conducive environment for lenders to capitalize on the financial struggles of citizens.

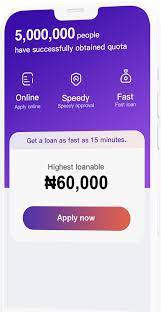

Nigeria currently boasts nearly 200 licensed online lenders, as reported by the Federal Competition and Consumer Protection Commission, with additional unlicensed operators believed to be in operation. Leading the market, the apps of OKash and Palmcredit have collectively garnered more than 5 million downloads, reflecting the growing reliance on digital lending solutions amid economic uncertainties.