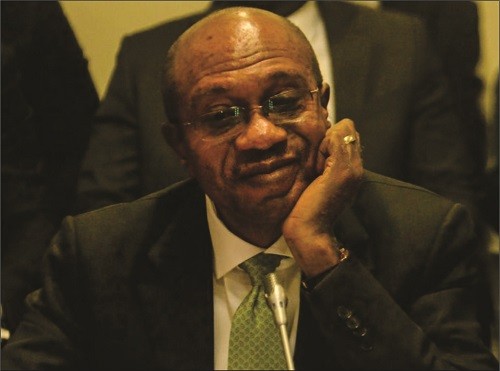

In a startling revelation, a report by special investigator Jim Obazee, appointed by President Bola Ahmed Tinubu, alleges that the former Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, utilized proxies to acquire Union Bank of Nigeria (UBN) and was involved in the acquisition of Keystone Bank and Polaris Bank. The acquisitions were reportedly carried out separately over time, according to the report submitted to President Tinubu on December 20, 2023.

The investigation, initiated on July 30, 2023, has uncovered damning details surrounding the Union Bank acquisition. The report, titled “Report of the Investigation of the Acquisition of Union Bank of Nigeria by Titan Trust Bank,” reveals that Titan Trust Bank (TTB) acted as the Special Purpose Vehicle (SPV) for the acquisition. The documents obtained from the CBN indicate that TTB sought the CBN’s approval in four phases, including the acquisition of 91.5% of Union Bank’s issued shares and a Mandatory Tender Offer (MTO). The report alleges that Emefiele used proxies to set up Titan Trust Bank, utilizing ill-gotten wealth. The investigation aims to recover both banks for the federal government.

Similarly, the report on the acquisition of Keystone Bank exposes financial irregularities. Titled “Report of the Investigation of the Acquisition of Keystone Bank,” the document suggests that proxies, with the assistance of Emefiele and the CBN, were used to acquire Keystone Bank without evidence of payment. The report details a complex financial arrangement involving a loan from Heritage Bank and internal loans created by Keystone Bank, raising questions about the legitimacy of the acquisition.

The special investigator has commenced the interrogation of the Managing Director of the Asset Management Corporation of Nigeria (AMCON) to clarify the situation regarding the acquisition of Keystone Bank. Preliminary reports suggest that Keystone Bank was acquired for free, further intensifying concerns about the transparency and legality of the acquisition.

While Union Bank and Keystone Bank have not yet reacted to the report, the investigation is poised to bring to light the alleged financial misconduct and the involvement of key figures in these high-profile bank acquisitions.